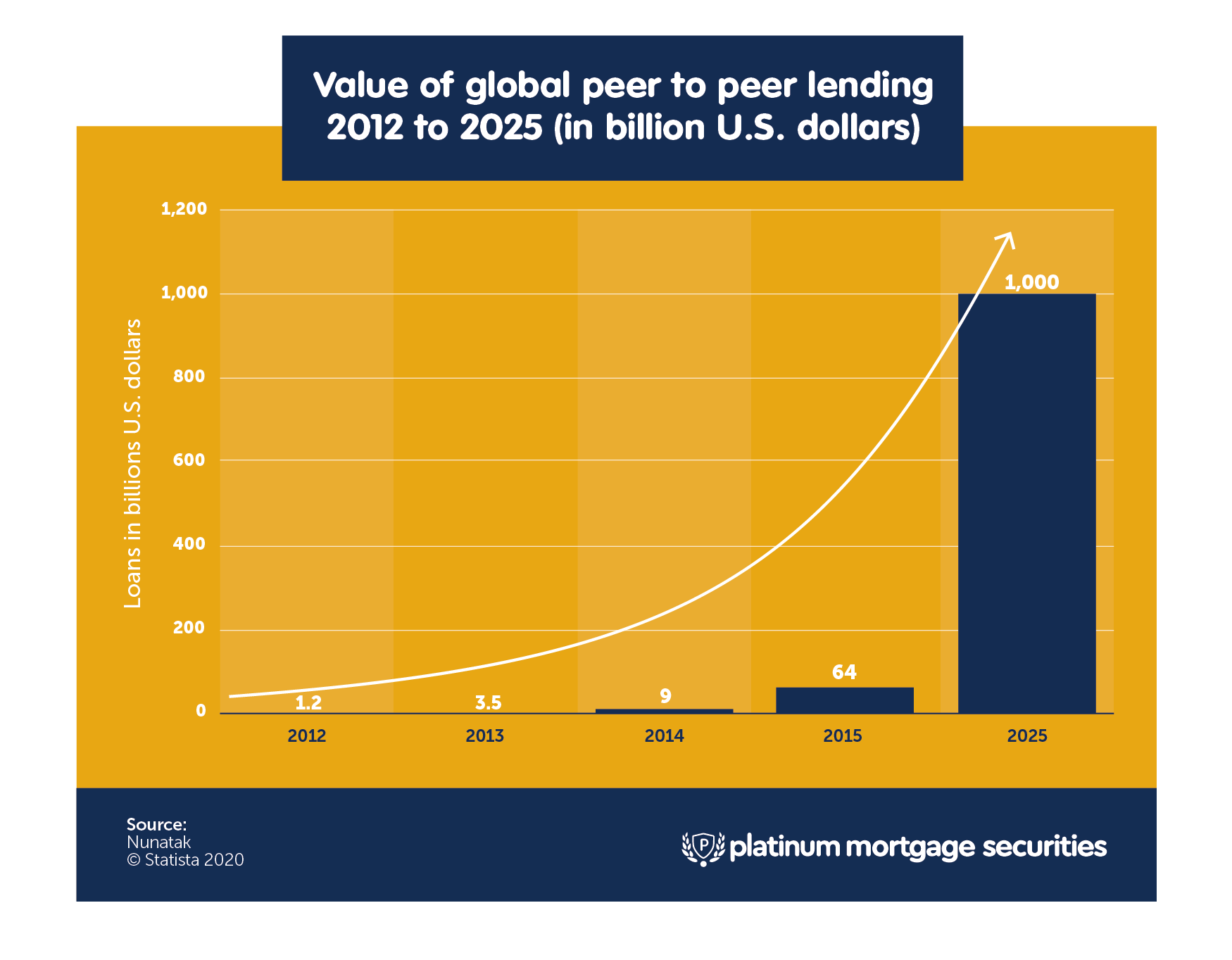

| Our journey into first mortgage secured, private business lending began back in 2012. Over the years, we have seen tremendous growth in our industry. By investing through Platinum Mortgage Securities, you are helping business borrowers that need short-term or bridging finance. All loans are first mortgage secured, giving you a safety net for your investment. OUR BORROWERS ARE SMALL TO MEDIUM BUSINESSES & PROPERTY DEVELOPERS THAT REQUIRE LOANS FOR A WIDE RANGE OF REASONS, INCLUDING:

|  |

Decades of ExperienceOur directors and operations team have decades of experience in property secured lending through all phases of the property and business cycles. Leveraging this experience, we develop smart and flexible loan solutions for our borrowers. We work closely with them to bring about satisfactory outcomes for all. |  Exceptional Track RecordWe have proven our ability to understand business needs, assess credit risk and property value, tailor loan terms and manage debt. Our team has facilitated well over $200 million worth of secured loans over the last 8 years with 100% return of capital to date. |  Great ServiceOur customers are looked after by our trained and professional team – with prompt service and transparent communication every step of the way. We continuously strive to build strong relationships with our borrowers, investors and partners. |

Call us to find out more about how our funds operate and how you can participate in them.

We can discuss your situation so you can make an informed decision.

Alternatively, complete the enquiry form below and one of our experienced team members will be in touch with you shortly.

ENQUIRE NOW