For property-secured debt investments

![]()

Expand your investment portfolio with fixed interest debt investments

![]()

Mortgage secured loans paying returns from 6% to 12% pa

![]()

Diversify across loan purposes, security property types and geography

Bicton, WA

Available for Investment $730,000

LVR 61%

Term Remaining 3 months

Return (Fixed) 10%

Security Type Residential Development

MORE INFO

Facility Amount $7,000,000

Amount Advanced $6,270,000

LVR 61%

Original Term 15 months

Term Remaining 3 months

Return (Fixed) 10%

Security Type Residential Development

Property Location Bicton

Property Value $11,512,000

Available for Investment $730,000

The borrower was granted a facility to assist with the purchase and renovation of a 2-level residential unit complex in Bicton comprising 36 strata titled units.

Once completed, the units will be sold, or retained for long-term investment.

If you are interested in this investment, please complete the form below and select the Request IM button. This will send an email to our investment team registering your interest in this investment. An Information Memorandum (IM) will be emailed to you.

Dunsborough, WA

Available for Investment $525,000

LVR <60%

Term Remaining 5 months

Return (Fixed) 9.50%

Security Type Residential

MORE INFO

Facility Amount $2,700,000

Amount Advanced $2,175,000

LVR <60%

Original Term 12 months

Term Remaining 5 months

Return (Fixed) 9.50%

Security Type Residential

Property Location Dunsborough, WA

Property Value $4,500,000

Available for Investment $525,000

This loan facility is being used to fund a significant renovation of a holiday home in Dunsborough.

Loan repayment is to be via refinance upon completion of the project.

If you are interested in this investment, please complete the form below and select the Request IM button. This will send an email to our investment team registering your interest in this investment. An Information Memorandum (IM) will be emailed to you.

Como, WA

Available for Investment $1,240,000

LVR <70%

Term Remaining 3 months

Return (Fixed) 10%

Security Type Residential Development

MORE INFO

Facility Amount $6,000,000

Amount Advanced $4,760,000

LVR <70%

Original Term 30 months

Term Remaining 3 months

Return (Fixed) 10%

Security Type Residential Development

Property Location Como

Property Value $8,625,000

Available for Investment $1,240,000

This loan facility has been used to fund construction of two townhouses and 12 apartments over 4 floors on a prime development site in Como, WA

The loan will be repaid via the sale of the completed apartments.

If you are interested in this investment, please complete the form below and select the Request IM button. This will send an email to our investment team registering your interest in this investment. An Information Memorandum (IM) will be emailed to you.

Walliston, WA

Available for Investment $1,014,000

LVR 60%

Term Remaining 7 months

Return (Fixed) 10.50%

Security Type Residential Lot Development

MORE INFO

Facility Amount $5,350,000

Amount Advanced $4,336,000

LVR 60%

Original Term 30

Term Remaining 7 months

Return (Fixed) 10.50%

Security Type Residential Lot Development

Property Location Walliston, WA

Property Value $8,960,000

Available for Investment $1,014,000

This is a progressively drawn facility used by the borrower to fund the land purchase and then the development of 24 residential lots in Walliston, WA.

The loan will be repaid from the sale of the lots which are being marketed via several sales channels.

If you are interested in this investment, please complete the form below and select the Request IM button. This will send an email to our investment team registering your interest in this investment. An Information Memorandum (IM) will be emailed to you.

North Perth, WA

Available for Investment $845,000

LVR 63%

Term Remaining 6 months

Return (Fixed) 9.00%

Security Type Commercial Development

MORE INFO

Facility Amount $3,740,000

Amount Advanced $2,895,000

LVR 63%

Original Term 27 months

Term Remaining 6 months

Return (Fixed) 9.00%

Security Type Commercial Development

Property Location North Perth

Property Value $5,900,000

Available for Investment $845,000

The Borrower needed funding for the construction of a childcare centre licensed for 76 children to be leased by a professional operator under a 15-year lease contract.

The loan will be repaid through the sale of the completed building with lease.

If you are interested in this investment, please complete the form below and select the Request IM button. This will send an email to our investment team registering your interest in this investment. An Information Memorandum (IM) will be emailed to you.

Martin, WA

Available for Investment NIL

LVR 61%

Term Remaining NIL

Return (Fixed) 11.00%

Security Type Residential land - 19 titled lots

MORE INFO

Facility Amount $2.055,000

Amount Advanced $2,017,000

LVR 61%

Original Term 12 months

Term Remaining NIL

Return (Fixed) 11.00%

Security Type Residential land - 19 titled lots

Property Location Martin, WA

Property Value $3,355,000

Available for Investment NIL

This loan facility will be utilised to refinance part of a current land loan with private investors with the balance to fund the construction of 3 houses. Another 3 houses are being funded by equity, including a display home already completed.

The security property comprises 19 lots in Martin which have been subdivided by the borrower and titles have already been issued.

Loan repayment is to be via the sale of completed units.

Northbridge, Perth WA

Available for Investment NIL

LVR <30%

Term Remaining NIL

Return (Fixed) 10.75% pa

Security Type Commercial

MORE INFO

Facility Amount $2,720,000

Amount Advanced $2,720,000

LVR <30%

Original Term 36 months

Term Remaining NIL

Return (Fixed) 10.75% pa

Security Type Commercial

Property Location Northbridge

Property Value $9,800,000

Available for Investment NIL

This is a term loan to fund the operations and refurbishment of a long established entertainment business in central Perth.

Tuart Hill, WA

Available for Investment NIL

LVR <40%

Term Remaining NIL

Return (Fixed) 10.00% pa

Security Type Residential

MORE INFO

Facility Amount $1,145,000

Amount Advanced $1,145,000

LVR <40%

Original Term 16 months

Term Remaining NIL

Return (Fixed) 10.00% pa

Security Type Residential

Property Location Tuart Hill, WA

Property Value $3,036,000

Available for Investment NIL

An experienced Developer originally took a $3,500,000, sixteen-month facility to refinance a land loan and fund the construction of five 3×2 townhouses plus interest and fees. The loan was secured by a registered first mortgage over the development site in Tuart Hill at a maximum 60% loan to value ratio.

The Developer has successfully completed several development projects including house and land developments, land subdivisions and built form construction, with a number of other developments underway. The contracted builder has been building quality homes in and around Perth for over 40 years.

The security property comprises of two adjoining lots which were subdivided into 15 individual lots. With titles now issued and the project completed there are six townhouses and nine vacant lots.

The loan was partly settled through sales with the remaining balance rolled over for a further 12 month period at an LVR of <40%. Final settlement was via the sale of remaining units and lots as required.

Beckenham, WA

Available for Investment NIL

LVR 54%

Term Remaining NIL

Return (Fixed) 9.50% pa

Security Type Residential land - 25 titled lots

MORE INFO

Facility Amount $2,278,000

Amount Advanced $2,278,000

LVR 54%

Original Term 12 months

Term Remaining NIL

Return (Fixed) 9.50% pa

Security Type Residential land - 25 titled lots

Property Location Beckenham, WA

Property Value $4,253,000

Available for Investment NIL

This is a house and land development loan. The borrower is a large offshore fund operating in joint venture with a well reputed and highly experienced local project marketing, construction, financial services and real estate sales group. The subject properties are already titled and sales have commenced.

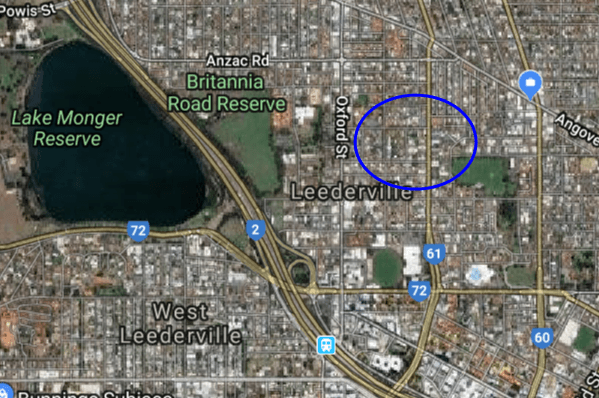

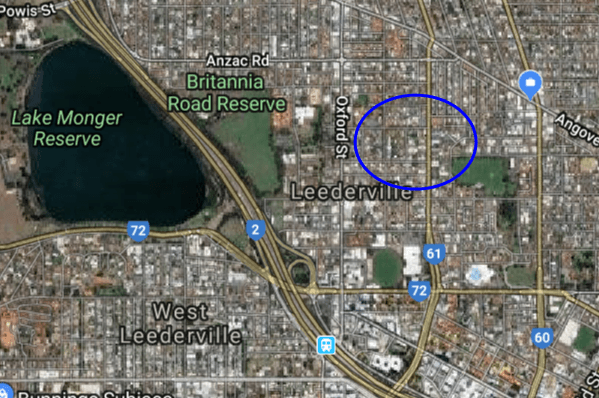

Leederville, WA

Available for Investment NIL

LVR 60%

Term Remaining NIL

Return (Fixed) 10.75%

Security Type Residential

MORE INFO

Facility Amount $1,020,000

Amount Advanced $1,020,000

LVR 60%

Original Term 12 months

Term Remaining NIL

Return (Fixed) 10.75%

Security Type Residential

Property Location Leederville, WA

Property Value $1,700,000

Available for Investment NIL

This loan of $1,235,000 was to assist with the purchase of two adjacent development properties in Leederville. The Borrower demolished the existing houses and intends to develop 14 units on the consolidated site.

The loan was secured by a registered first mortgage over the two lots measuring a combined 1,214 sqm at a 65% loan to value ratio.

The loan was repaid via development finance for the construction of the apartment complex by a mainstream lender.

The developer, who is well known to Platinum, has successfully completed many development projects including house and land developments, land subdivisions and built form construction, and has several other development projects currently underway.

Osborne Park, WA

Available for Investment NIL

LVR <50%

Term Remaining Nil

Return (Fixed) 11.75% pa

Security Type Commercial

MORE INFO

Facility Amount $3,700,000

Amount Advanced $3,700,000

LVR <50%

Original Term 12 months

Term Remaining Nil

Return (Fixed) 11.75% pa

Security Type Commercial

Property Location Osborne Park

Property Value $7,760,000

Available for Investment NIL

This 12 month loan of $3,700,000 was to assist with the purchase of a vacant development site in Osborne Park and the construction of 12 commercial units.

The loan was repaid from the sale of the completed units.

Ascot, WA

Available for Investment NIL

LVR 33%

Term Remaining NIL

Return (Fixed) 10.75% pa

Security Type Residential

MORE INFO

Facility Amount $1,650,000

Amount Advanced $1,346,000

LVR 33%

Original Term 12 months

Term Remaining NIL

Return (Fixed) 10.75% pa

Security Type Residential

Property Location Ascot, WA

Property Value $5,000,000

Available for Investment NIL

The Borrower has requested a twelve month, $1.650m loan to complete construction of ten apartments.

The loan will be secured by a registered first mortgage over the development site in Ascot, WA at a 33% loan to value ratio upon completion

The loan is expected to be repaid by the sale/refinance of the completed apartments.

Northbridge, WA

Available for Investment $0.00

LVR 67%

Term Remaining 0

Return (Fixed) 10.00% pa

Security Type Residential

MORE INFO

Facility Amount $2,583,000

Amount Advanced $2,583,000

LVR 67%

Original Term 12 months

Term Remaining 0

Return (Fixed) 10.00% pa

Security Type Residential

Property Location Northbridge, WA

Property Value $4,050,000

Available for Investment $0.00

An experienced Developer has requested a twelve month, $2.58m loan to assist with the purchase of a development site in Northbridge, WA. The purchase price of the site is $3.80m (excl GST) of which the borrower will contribute approximately $1.30m including deposit and settlement costs.

The loan will be secured by a registered first mortgage over two adjacent properties measuring a total of 964 sqm at a 64% loan to value ratio.

The Borrower will immediately seek to obtain the required plans and approvals to develop the site into an expected mix use 5 story development, accommodating 24 apartments (20 2x2s and 4 studios) and 2 commercial units.

The initial feasibility of the development project reports a gross realisable value of $13.0m, development costs of $9.2m and financing costs of $1.5m which results in an expected gross profit of $2.3m.

The Developer has successfully completed several development projects including house and land developments, land subdivisions and built form construction, with a number of other developments underway. The Developer is well known to the Platinum directors.

The loan is expected to be repaid via development finance for the construction of the apartment complex by a mainstream lender.

This loan facility is simply a land loan over the site and does not involve the construction of the development. This reduces the risk profile of the investment significantly.

Currambine, WA

Available for Investment $0.00

LVR 67%

Term Remaining 0

Return (Fixed) 11.00% pa

Security Type Residential

MORE INFO

Facility Amount $1,435,000

Amount Advanced $1,435,000

LVR 67%

Original Term 6 months

Term Remaining 0

Return (Fixed) 11.00% pa

Security Type Residential

Property Location Currambine, WA

Property Value $2,145,500

Available for Investment $0.00

An experienced Borrower has development approval to construct a two level, six-unit residential apartment complex in Currambine, WA.

The apartments will be two bedrooms, two bathrooms and are expected to sell on average for $385k each. The apartments are ideally located only 450m from the Currambine train station.

The construction loan, with multiple funding draws, will be secured by a registered first mortgage over the development site in Currambine, at a 67% loan to value ratio on an “as if complete” basis.

The loan is expected to be repaid by the sale of the newly titled apartments. To date, there are two pre-sales (valued at $790k) and three expressions of interest for the units. Once the pre-sold units have settled it is expected the residual LVR against the remaining debt will reduce to 52%.

Settlement of the apartment sales may be staggered and if this was to occur, funds will be returned to Investors on a pro rata basis.

Construction of the apartment complex is 80% complete as per the quantity surveyor report dated 04/05/2018.

All draws have been funded to date. We expect the next draw to be available for funding in June 2018.

Como, WA

Available for Investment $0.00

LVR 69%

Term Remaining 0

Return (Fixed) 10.25% pa

Security Type Residential Development

MORE INFO

Facility Amount $1,150,000

Amount Advanced $1,150,000

LVR 69%

Original Term 12 months

Term Remaining 0

Return (Fixed) 10.25% pa

Security Type Residential Development

Property Location Como, WA

Property Value $1,660,000

Available for Investment $0.00

The Borrower requested a $1.150m, twelve-month loan to assist with the purchase of a development site in Como, WA. The purchase price of the site is $1,660,000 of which the borrower will contribute approximately $600k, including the deposit and settlement costs.

The loan will be secured by a registered first mortgage over the development site located in Como, at a 69% loan to value ratio.

Bassendean, Belmont, WA

Available for Investment $0

LVR Under 50%

Term Remaining Nil

Return (Fixed) 10.00% pa

Security Type Residential

MORE INFO

Facility Amount $2,300,400

Amount Advanced $2,300,400

LVR Under 50%

Original Term 12 months

Term Remaining Nil

Return (Fixed) 10.00% pa

Security Type Residential

Property Location Bassendean, Belmont, WA

Property Value $5,050,000

Available for Investment $0

The Borrower has requested a twelve month, $2.3m loan to refinance their current lender.

The loan will be secured by a registered first mortgage over three residential properties located in Bassendean, Caversham and Belmont, WA at a 50% loan to value ratio.

The loan is expected to be repaid by the sale of other property assets.

Nedlands, WA

Available for Investment $0.00

LVR 65%

Term Remaining 0 months

Return (Fixed) 10.00% pa

Security Type Residential

MORE INFO

Facility Amount $958,000

Amount Advanced $958,000

LVR 65%

Original Term 6 months

Term Remaining 0 months

Return (Fixed) 10.00% pa

Security Type Residential

Property Location Nedlands, WA

Property Value $1,475,000

Available for Investment $0.00

The Borrower requested a six-month loan facility to assist in the acquisition of trading assets currently owned by a local waste management company.

The loan will be secured by a registered first mortgage over a residential property in Nedlands, WA at a 65% loan to value ratio. In addition, the Lender will register a first ranking PPSR charge over the assets of the Borrower.

The loan is expected to be repaid via the cash flow generated by the three waste businesses.

Piara Waters, WA

Available for Investment $0.00

LVR 51%

Term Remaining 0 months

Return (Fixed) 11.00% pa

Security Type Residential

MORE INFO

Facility Amount $1,582,000

Amount Advanced $1,582,000

LVR 51%

Original Term 12 months

Term Remaining 0 months

Return (Fixed) 11.00% pa

Security Type Residential

Property Location Piara Waters and Bedfordale, WA

Property Value $3,090,000

Available for Investment $0.00

The Borrowers requested a twelve-month loan to refinance their current facility from CEG Direct Securities (CEG). The loan will be secured by a registered first mortgage over a residential property in Piara Waters (WA) and a rural-residential property in Bedfordale (WA), at a 51% loan to value ratio.

The Piara Waters property is a circa 2013, four bedroom, two bathroom house on a 576 sqm block. The Bedfordale property is a 9.60 ha site and comprises two, four bedrooms, two bathroom houses, a granny flat and sheds. The total combined value of the security properties is $3,090,000.

The loan is expected to be repaid via refinancing from a long-term lender. As the sisters had successfully secured a mainstream funding facility previously and anticipate sound FY18 financials, they expect to secure long-term finance again. With positive operating financials and a sub, 55% loan to value ratio, refinance from a mainstream bank or a second-tier lender is deemed feasible.

South Perth, WA

Available for Investment $0.00

LVR 65%

Term Remaining 0 months

Return (Fixed) 9.00% pa

Security Type Residential Development

MORE INFO

Facility Amount $3,445,000

Amount Advanced $3,445,000

LVR 65%

Original Term 3 months

Term Remaining 0 months

Return (Fixed) 9.00% pa

Security Type Residential Development

Property Location South Perth, WA

Property Value $5,300,000

Available for Investment $0.00

A facility for $3.445m has been approved for a term of two months. Additional funds of$700k will be used for working capital and the cost of the forward works which have commenced. The facility will continue to be secured by a registered first mortgage over the property located in South Perth WA, at a 65% loan to value ratio.

Mosman Park, WA

Available for Investment $0.00

LVR 65%

Term Remaining 0 months

Return (Fixed) 9.50% pa

Security Type

MORE INFO

Facility Amount $1,365,000

Amount Advanced $1,365,000

LVR 65%

Original Term 12 months

Term Remaining 0 months

Return (Fixed) 9.50% pa

Security Type

Property Location Mosman Park, WA

Property Value

Available for Investment $0.00

Bull Creek, WA

Available for Investment $0.00

LVR 27%

Term Remaining 0 months

Return (Fixed) 9.75% pa

Security Type Residential

MORE INFO

Facility Amount $530,000

Amount Advanced $530,000

LVR 27%

Original Term 12 months

Term Remaining 0 months

Return (Fixed) 9.75% pa

Security Type Residential

Property Location Bull Creek, WA

Property Value $2,000,000

Available for Investment $0.00

The Borrower requested a twelve-month loan facility to assist in funding a small land subdivision in Buderim, QLD. The loan will be secured by an 8 bedroom, 5 bathroom residential property in Bull Creek, WA at a 27% loan to value ratio.

The proposed land subdivision will transform a single residential lot (2,285sqm) into five smaller residential lots. Upon completion, the newly titled lots are expected to sell at an average price of $369,000. The development feasibility has been provided to the Lender and it appears viable and appropriate for the location.

The loan is expected to be repaid via the proceeds generated from the sale of the completed subdivided lots.

Doubleview, WA

Available for Investment $0.00

LVR 65%

Term Remaining 0 months

Return (Fixed) 10.95% pa

Security Type Residential

MORE INFO

Facility Amount $1.400,000

Amount Advanced $1.400,000

LVR 65%

Original Term 14 months

Term Remaining 0 months

Return (Fixed) 10.95% pa

Security Type Residential

Property Location Nedlands, WA

Property Value

Available for Investment $0.00

Mirrabooka, WA

Available for Investment $0.00

LVR 60%

Term Remaining 0 months

Return (Fixed) 11.00% pa

Security Type Residential

MORE INFO

Facility Amount $2,025,000

Amount Advanced $2,025,000

LVR 60%

Original Term 12 months

Term Remaining 0 months

Return (Fixed) 11.00% pa

Security Type Residential

Property Location Mirrabooka, Attadale, Applecross, WA

Property Value $3,375,000

Available for Investment $0.00

The Borrower requested finance to purchase a development site in Mirrabooka, WA and fund the soft costs associated with obtaining DA and presales for its development. The facility was secured by the development site and two quality residential properties, one in Attadale and the other in Applecross, at a 70% loan to value ratio. The development site is located centrally within the Mirrabooka Town Centre, 11kms north-east of the Perth CBD, within the local government area of the City of Stirling. The Borrower will seek approval from the local council to develop the site into a three-level apartment complex consisting of 41 apartments and 2 commercial units.

The apartment design is subject to council approval and is expected to consist of 28 x 2 bedroom, 5 x 1 bedroom and 8 x studio apartments, with an average selling price of $388k. The large commercial units are estimated at an average selling price of $1.8m each. The construction is expected to cost $12.0m excluding financing costs, with an estimated gross realisation value of $19.1m (ex GST).

Presales are not expected until development approval has been secured and a marketing campaign launched. Apartment price points have been set to appeal to both the first home buyer and investor market. Dome Café has expressed an interest in one of the commercial units.

South Perth, WA

Available for Investment $0.00

LVR 55%

Term Remaining 0 months

Return (Fixed) 10.00% pa

Security Type

MORE INFO

Facility Amount $2,711,500

Amount Advanced $2,711,500

LVR 55%

Original Term 9 months

Term Remaining 0 months

Return (Fixed) 10.00% pa

Security Type

Property Location South Perth, WA

Property Value

Available for Investment $0.00

Leeming, WA

Available for Investment $0.00

LVR 75%

Term Remaining 0 months

Return (Fixed) 10.00% pa

Security Type Residential

MORE INFO

Facility Amount $548,000

Amount Advanced $548,000

LVR 75%

Original Term 6 months

Term Remaining 0 months

Return (Fixed) 10.00% pa

Security Type Residential

Property Location Leeming, WA

Property Value $730,000

Available for Investment $0.00

The Borrower requested funding to take up an investment opportunity in a water management and treatment company operating in South Australia. The company has recently won some major contracts with government and mining industries in that state.

The six-month loan was secured by a recently inherited residential property located at, Leeming WA, at a 75% loan to value ratio.

The loan was repaid by the sale of the security property.

Two Rocks, WA

Available for Investment $0.00

LVR 63%

Term Remaining 0 months

Return (Fixed) 10.50% pa

Security Type Commercial

MORE INFO

Facility Amount $2,965,000

Amount Advanced $2,965,000

LVR 63%

Original Term 10 months

Term Remaining 0 months

Return (Fixed) 10.50% pa

Security Type Commercial

Property Location Two Rocks, WA

Property Value $4,960,000

Available for Investment $0.00

The Borrower requested $2.965m in funding to assist with the purchase of a future private school site in Two Rocks from the vendor wanting urgent payment. The ten-month facility provided sufficient time for the Borrower to arrange long-term finance from the WA State Government’s Low-Interest Loan Scheme. The loan will be secured by registered first mortgages over three primary properties, second mortgages over four other properties and a bank guarantee. The total loan security is valued at $4.690m, ensuring a 63% loan to value ratio at the inception of the facility.

The loan is expected to be repaid via the Low-Interest Loan Scheme (LILS), an initiative of the WA State Government to assist non-government schools in funding capital development projects including land acquisition, new building construction and upgrading established facilities.

If for any reason the LILS funding does not eventuate, refinance of the facility is deemed feasible via a mainstream lender given the sub 65% loan to value ratio.

Peppermint Grove, WA

Available for Investment $0.00

LVR 52%

Term Remaining 0 months

Return (Fixed) 9.00% pa

Security Type Residential

MORE INFO

Facility Amount $2,455,000

Amount Advanced $2,455,000

LVR 52%

Original Term 6 months

Term Remaining 0 months

Return (Fixed) 9.00% pa

Security Type Residential

Property Location Peppermint Grove, WA

Property Value $5,174,000

Available for Investment $0.00

The Borrower requested a six-month loan to refinance a facility from the Bank of Queensland. The loan was secured by a registered first mortgage over a residential property located in Peppermint Grove, WA at a 55% loan to value ratio.

East Perth, WA

Available for Investment $0.00

LVR 60%

Term Remaining 0 months

Return (Fixed) 11.75% pa

Security Type Residential

MORE INFO

Facility Amount $4,600,000

Amount Advanced $4,600,000

LVR 60%

Original Term 6 months

Term Remaining 0 months

Return (Fixed) 11.75% pa

Security Type Residential

Property Location Eat Perth, WA

Property Value $7,940,000

Available for Investment $0.00

The borrower is a property developer who has recently completed the 56 unit, development at, East Perth, WA.

Construction of the Apartments was financed by a non-bank lender from the Eastern States. Due to the onerous fees structure imposed, the Group requested a more competitive finance package from Platinum to complete the final stages of the sales-process and to initiate a possible future funding relationship.

The loan was repaid via cash flow from the fourteen pending settlements, sales of the six unsold units and refinance of the twelve residual units by a mainstream bank.

Yokine, WA

Available for Investment $0.00

LVR 50%

Term Remaining 0 months

Return (Fixed) 10.75% pa

Security Type

MORE INFO

Facility Amount $2,495,000

Amount Advanced $2,495,000

LVR 50%

Original Term 12 months

Term Remaining 0 months

Return (Fixed) 10.75% pa

Security Type

Property Location Yokine, WA

Property Value

Available for Investment $0.00

We arrange mortgage secured term loans to borrowers that require funding for business or investment purposes, and offer great opportunities to investors, both wholesale and institutional, looking for attractive fixed interest investment returns through property secured lending.

![]()

For borrowers – interest rates from 7% pa

For investors – returns from 6% pa

![]()

Our team has facilitated well over $200 million worth of secured loans over the last 8 years with 100% return of capital to date.

![]()

We understand that business opportunities come and go quickly. We act urgently – with credit decisions in principle in hours and settlement in days as required.

![]()

We fund borrowers quickly and efficiently by matching them to investors with the appropriate risk appetites.

![]()

Investors generally select each loan investment directly themselves. In some fund situations investors can mandate us to assign them to loans that meet their investment criteria.

![]()

Our customers are looked after by our trained and professional team – with prompt service and transparent communication every step of the way.

Start investing by lending your money to property owners and support their business & development process.

Choose each loan you want to invest or let us do it for you based on your criteria. Interets is paid monthly into your account.

Download the Information Memorandum (IM)

The IM tells you everything you need to know about the fund.

Register

Fill out the Fund Application Form and register with us as an investor. More details available here.

Select your investments & transfer funds

Assess and select loan investment opportunities sent to you.

Investor Education: Investing in Construction Loans

Insight into the current state of the lending landscape and information for investors on investing in construction loans.

READ MORE

SMSFs, technology and private investing

Technology provides great new opportunities for SMSFs.

READ MORE

What are the positives and negatives of a SMSF?

Starting an SMSF is an attractive alternative to managing your retirement fund, especially if you are dissatisfied with the returns from your current Super Fund.

READ MORECall us to find out more about how our funds operate and how you can participate in them.

We can discuss your situation so you can make an informed decision.

Alternatively, complete the enquiry form below and one of our experienced team members will be in touch with you shortly.

ENQUIRE NOW